April 23, 2025

April 23, 2025

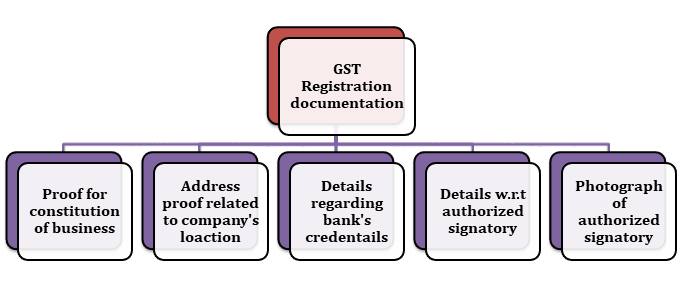

To streamline GST registration, the government has clarified document requirements for different premises:

A. Owned Premises

-

Submit any one of these:

-

Latest Property Tax Receipt

-

Municipal Khata Copy

-

Electricity Bill (Owner’s Name)

-

Water Bill or equivalent state/local document.

-

-

No additional documents (e.g., physical copies) should be demanded.

B. Rented Premises

-

Submit:

-

Valid Rent/Lease Agreement +

-

One ownership proof of the lessor (Property Tax/Municipal Khata/Electricity Bill).

-

-

Unnecessary Requests: Officers should not ask for the lessor’s PAN, Aadhaar, or photographs.

Tip: Upload correct documents to avoid registration delays.